Homebuying Made More Accessible with AHFC's Reduced Down Payment Requirement

Recent changes to Alaska Housing Finance Corporation’s loan-to-value (LTV) ratios are helping to bring homeownership goals within reach for more Alaskans.

For many prospective homebuyers, saving up for a down payment is one of the biggest obstacles to overcome on the road to homeownership. In 2024, Governor Dunleavy introduced, and the Alaska Legislature passed a bill that aims to help homebuyers overcome this by reducing the amount necessary for a down payment for those choosing an AHFC mortgage.

Governor Dunleavy signed House Bill 273 into law in July last year and authorized AHFC to adjust the ceiling on its loan-to-value ratios for mortgages. Raising the LTV ratio to 97%, up from 95%, maintains responsible underwriting while also giving prospective buyers an additional option when choosing the loan that is right for them and makes homeownership more accessible.

The tradeoff for a smaller down payment is a bump to the monthly payment a borrower will make so prospective homebuyers should work with their lender to determine which option is the best choice for their situation.

The 97% LTV option can be layered with most single-family mortgage programs offered by AHFC, not just first-time homebuyer programs. Prospective homebuyers choosing AHFC for their mortgage will have a choice between the 97% and 95% LTV options. This blog post is designed to share information to help buyers make more informed decisions.

Loan-to-Value Sample Scenario

Loan-to-value is a common term used by finance professionals to describe the ratio between a loan and the value of the asset, in this case a home.

In 2024, the average Anchorage home sales price with an AHFC First Home Limited or First Home loan was $404,359, requiring a minimum down payment of approximately $20,000. This upfront cost can be an obstacle for buyers who are able to afford monthly mortgage payments but struggle with the large upfront payment.

With the addition of the new option AHFC is making available that allows for a LTV ratio of 97%, Alaskan homebuyers now can put 3% down while lending for the balance.

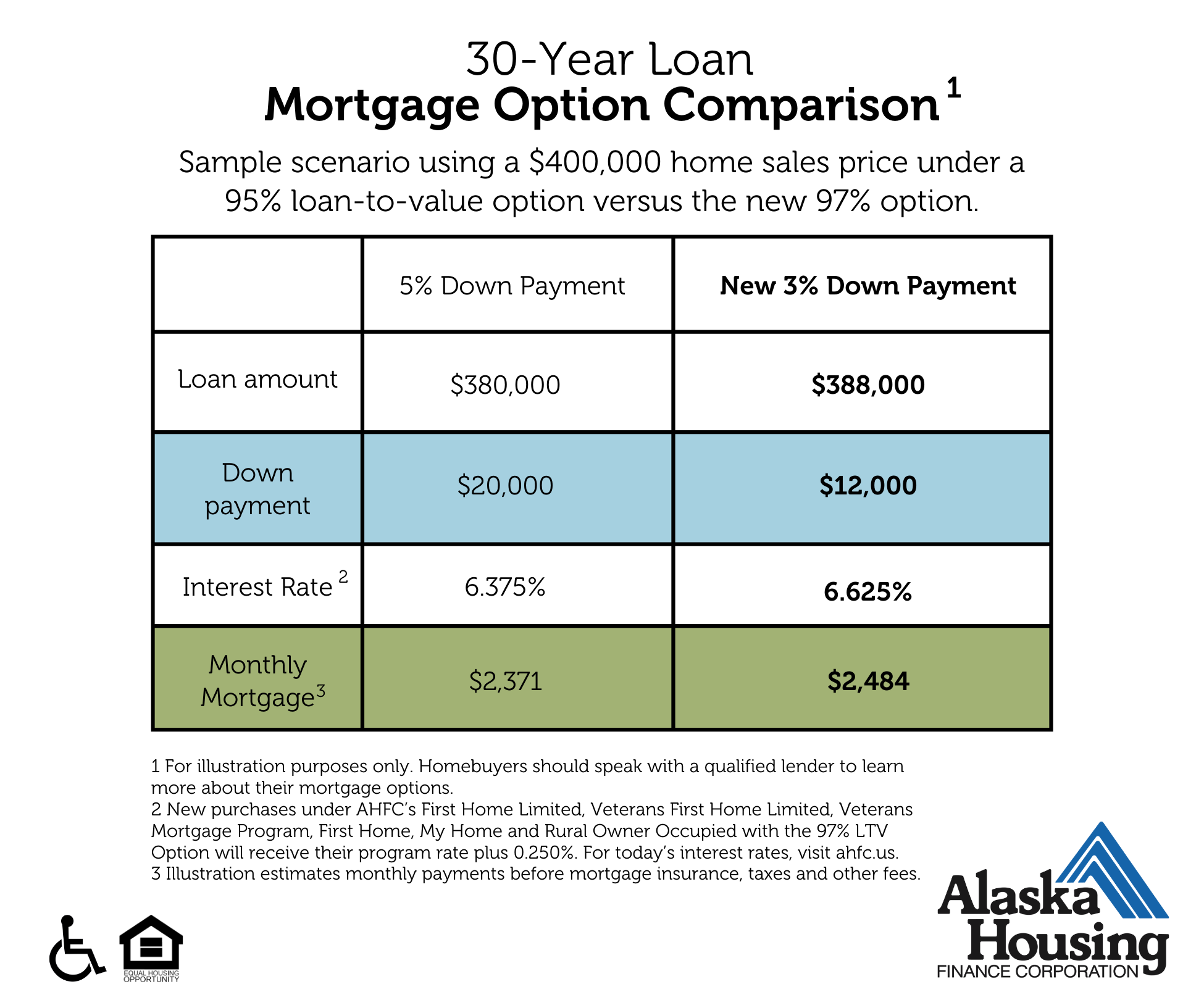

Depending on the interest rate of their loan, with a 3% down payment, buyers purchasing a home at a sales price of $400,000 could defer $8,000 upfront. This deferred cost is instead rolled into their loan, impacting the mortgage they’ll have to pay with a monthly increase of just more than $100.

To accommodate the added risk AHFC takes on through financing at the higher LTV, there is a cost to the borrower. 25 basis points, or ¼ of 1%, is added to the annual percentage rate on these loans. View the graphic below to see an illustration of how this works.

A Loan-to-Value Ratio indicates how a loan compares to the value of a home. In this example, the 97% LTV option would save a buyer about $8,000 up-front and the monthly mortgage would increase by $113 compared to the 95% option. An additional cost of 25 basis points or ¼ of 1% is added to the interest rate to address added risk to AHFC.

Example below is based on a $400,000 home sales price.

Learn More

Interested in buying a home with AHFC? Sign up for a free HomeChoice™ class and learn about the steps to homeownership, including which loan options are best for you.

When you’re ready to evaluate your loan options, contact an approved AHFC lender to learn more.

Lenders, find more information about this loan option in the AHFC Mortgage Guide.

AHFC's 97% Loan-to-Value option is available beginning Monday, March 17, 2025.

![Alaska Housing Finance Corporation [Logo]](/application/themes/ahf2/images/logo.png?v=2)