Understanding Assumable Mortgages

If you’re actively in the process of home shopping and through the prequalification stage, you may have heard this buzz phrase, especially when talking about lower interest rates of a few years ago: “assumable mortgages.” What does it mean to assume a loan? Which loans are assumable? When is it the right fit for Alaskan homebuyers?

In this post the AHFC mortgage department helps unpack this loaded term, including some recommended questions to ask when determining if an assumable loan is the right choice for you.

What is an assumable mortgage?

The word “assume” means take responsibility for. In this context, an assumable mortgage allows a buyer to take over the seller’s existing loan with the same loan servicer, including the same interest rate, the remaining balance and remaining term.

For example, if the seller of a home originally purchased the home using an AHFC First-Home loan with a 3% mortgage rate in 2021, and today’s rates in 2026 are closer to 6%, the buyer could assume or “take on” the seller’s 3% interest rate from 2021. If the same buyer took out a brand-new loan to purchase the home at 6%, their monthly mortgage payment would be much higher than if they assumed this hypothetical loan.

What’s the catch?

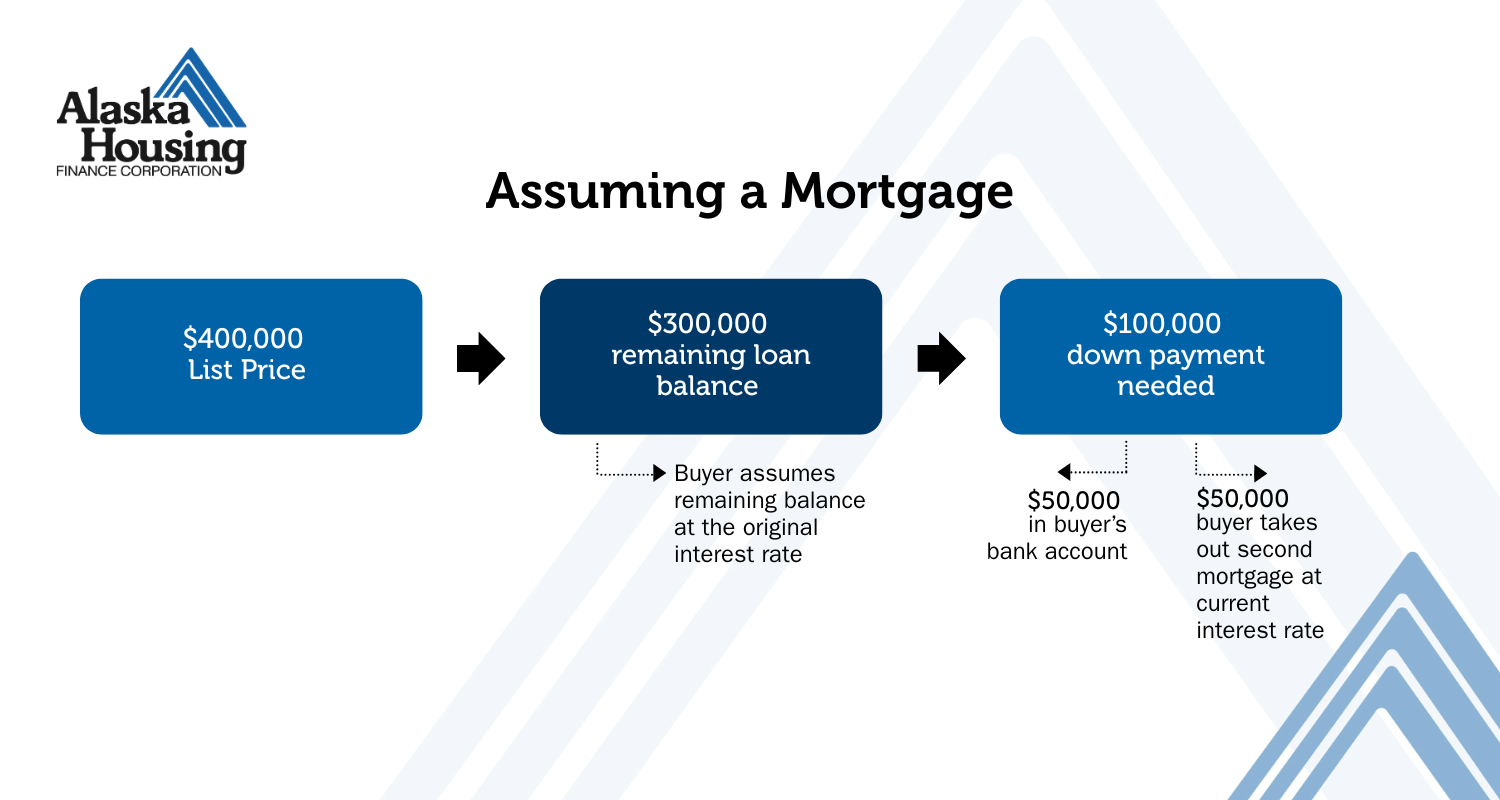

Assumable loans aren’t for everyone. If the home is listed at $400,000 and the seller owes $300,000, the buyer must cover the $100,000 difference out-of-pocket or with a second mortgage. Because of this, assumable mortgages tend to work better for buyers with significant savings or existing home equity, rather than first-time buyers.

A mortgage that has been assumed only includes the remaining balance on the seller’s loan and nothing more.

Prequalification is Key

Because assuming a loan requires a lot of back-and-forth interaction with a buyer and seller, due to the complicated financial nature of the transaction, it’s important to come to the table prequalified for a loan. Sellers want assurances that the buyer who will assume can afford it successfully.

Prequalification: The process of determining if a borrower qualifies for a mortgage loan and at what amount. Typically, this includes verifying credit, income and available funds of the borrower

Find more homebuying terms in AHFC’s HomeChoice workbook, available for free download.

Other important caveats to consider:

- While assumable mortgages can be attractive to buyers, sellers may weigh the potential downsides and opt for a more conventional sale.

- Assumptions take longer than traditional sales transactions. If there is a sense of urgency with the transaction, assumptions are generally not recommended.

- If the home’s market value significantly exceeds the loan balance, the seller might prefer a buyer who can secure financing at the full price, maximizing profit without complicating the transaction.

Looking at a home that was purchased with an AHFC loan?

Assumable-eligible mortgages occupy only a small portion of the market and can be hard to find but all AHFC single-family loans are assumable for qualified borrowers unless otherwise noted.

Quiz: Can I Benefit from an Assumable Loan?

You may benefit from an assumable loan if you respond “yes” to the following. Use the following prompts as guidance before speaking to a lender:

- Are you prequalified for a mortgage?

- Are you already interested in buying a home that comes with an assumable mortgage? You may not know if a home has an assumable loan unless your realtor asks directly.

- Are current interest rates higher than the assumable rate on the home you’re interested in?

- Where will the remaining funds come from? To cover the gap between the home’s purchase price and the seller’s remaining loan balance, you will need cash on-hand or secondary financing. If the financial gap is too large or if it strains your budget, assuming a mortgage might not be the best choice, even if it has a very low interest rate.

If you answered “yes” to these three questions, keep reading for more tips on how to successfully assume a loan and lock in a lower interest rate.

Steps for Assuming a Loan

1. Find a Realtor

Assumable mortgages are unique, so working with a knowledgeable Alaska real estate agent can help you identify opportunities. Tell your realtor you are interested in homes that offer assumable mortgages. You can also search real estate listings with the keyword “assumable.”

Tip: When shopping for a home, ask if the loan was purchased with an AHFC home loan. All AHFC single-family loans are assumable for qualified borrowers unless otherwise noted.

2. Ask Key Questions

Before assuming a mortgage you will want to know:

- The remaining mortgage balance

- Interest rate

- The remaining loan term

- Hidden costs (assumption fees, closing costs, etc.)

- Any special restrictions or conditions of the loan

Special Considerations for Alaska Veterans and VA Loans

VA loans in Alaska can also be assumable, but there are conditions to consider. Non-veterans may assume a VA loan, but the seller’s VA entitlement may remain tied to the property, limiting their ability to use the benefit for future home purchases. Sellers may remain partially liable if the buyer defaults.

Veterans in Alaska should carefully weigh these factors before agreeing to an assumption.

Special Circumstances for Mortgage Assumption

There are also personal and family situations where assumption may make sense:

- Divorce or Separation: One spouse may assume the mortgage to stay in the home, provided they qualify with the original lender on their own.

- Inheritance or Family Transfer: When a property passes from parent to child or through inheritance, the mortgage may be assumed to keep the home in the family.

- Military Relocation (PCS): Alaska’s large military community sometimes uses assumable mortgages to make homes more attractive to buyers when relocating.

Bottom Line on Assumable Loans for Alaskan Buyers

"Not all mortgages are assumable and while a lower interest rate can be advantageous in a market with rising interest rates, there are reasons why it might not be smart for the buyer or seller," says Stephanie Eddy, AHFC underwriting officer.

"Take the time to make sure you understand all the loan terms and costs. Think long-term and evaluate if it makes sense for your financial goals."

An assumable mortgage can create valuable savings for the right buyer, but it’s not a one-size-fits-all solution. If you’re exploring homeownership in Alaska, talk with trusted professionals to determine whether assuming a loan makes sense for your situation.

Find more homebuying terms in AHFC’s HomeChoice workbook, available for free download.

![Alaska Housing Finance Corporation [Logo]](/application/themes/ahf2/images/logo.png?v=2)